Hsmb Advisory Llc for Dummies

Hsmb Advisory Llc for Dummies

Blog Article

What Does Hsmb Advisory Llc Do?

Table of ContentsThings about Hsmb Advisory LlcSee This Report about Hsmb Advisory LlcNot known Facts About Hsmb Advisory LlcSome Known Questions About Hsmb Advisory Llc.The Facts About Hsmb Advisory Llc UncoveredIndicators on Hsmb Advisory Llc You Need To KnowThe Hsmb Advisory Llc Ideas

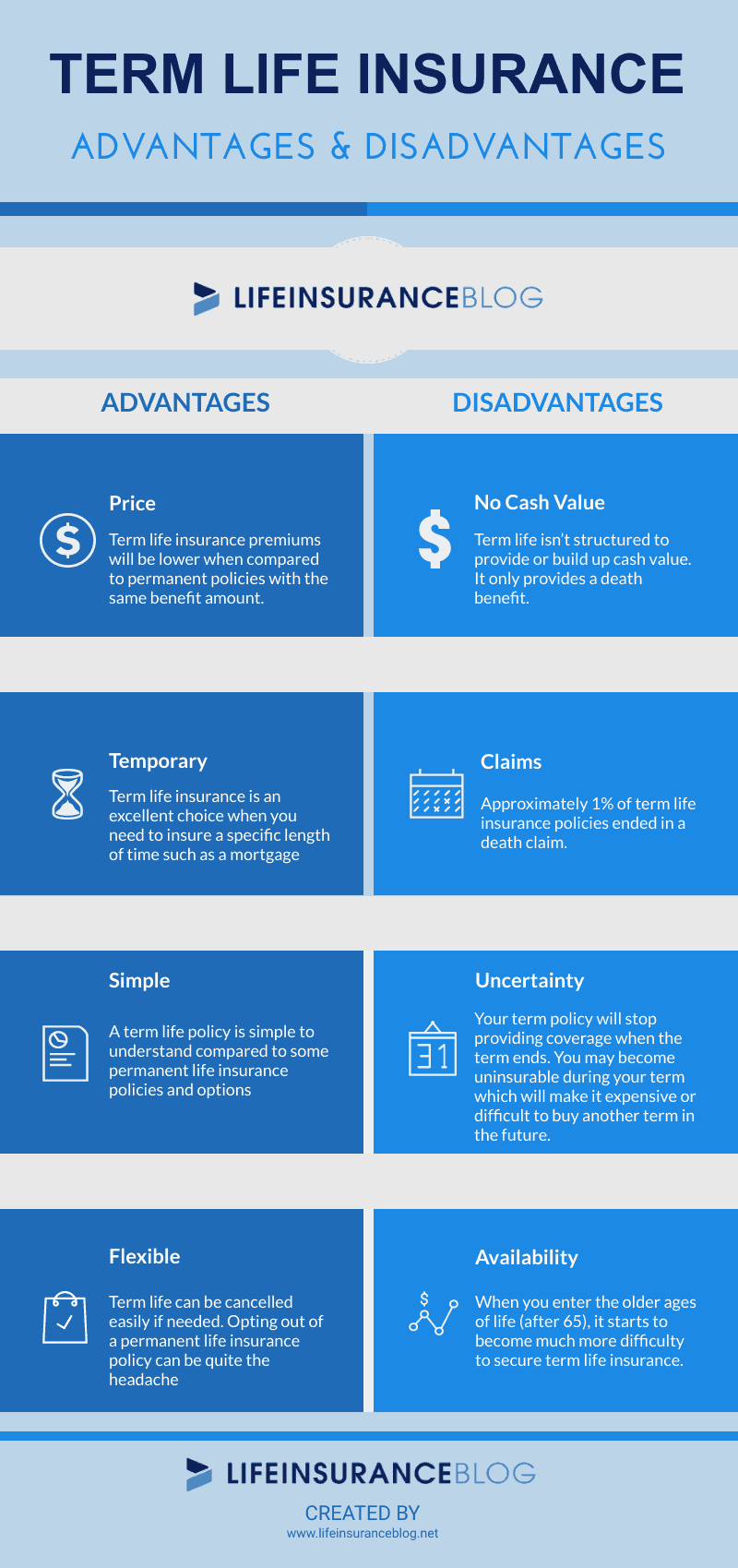

Under a level term policy the face quantity of the plan remains the exact same for the whole duration - https://www.bark.com/en/us/company/hsmb-advisory-llc/EeykR/. With decreasing term the face amount decreases over the period. The premium stays the very same yearly. Frequently such policies are sold as mortgage defense with the quantity of insurance policy lowering as the balance of the home loan decreases.Commonly, insurance firms have actually not had the right to transform costs after the policy is marketed. Considering that such policies might continue for several years, insurance firms need to utilize conservative death, rate of interest and cost rate price quotes in the premium calculation. Flexible premium insurance policy, nevertheless, permits insurance providers to offer insurance policy at lower "present" premiums based upon much less conservative presumptions with the right to change these costs in the future.

Some Known Factual Statements About Hsmb Advisory Llc

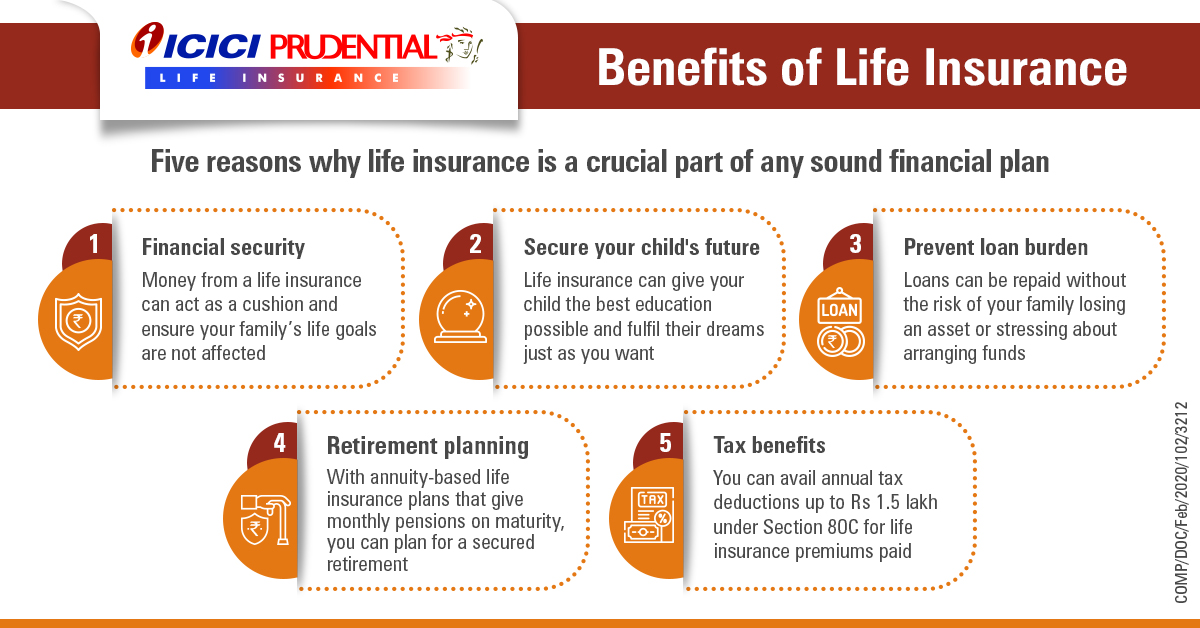

Under some plans, premiums are needed to be spent for a set variety of years. Under other plans, costs are paid throughout the insurance policy holder's life time. The insurance provider invests the excess costs bucks This sort of plan, which is in some cases called cash money value life insurance coverage, creates a savings component. Cash worths are critical to a long-term life insurance policy policy.

In some cases, there is no connection in between the dimension of the cash money worth and the costs paid. It is the cash money worth of the policy that can be accessed while the policyholder is alive. The Commissioners 1980 Requirement Ordinary Mortality (CSO) is the present table made use of in computing minimal nonforfeiture worths and policy books for normal life insurance policy plans.

Everything about Hsmb Advisory Llc

There are two standard classifications of permanent insurance coverage, typical and interest-sensitive, each with a number of variants. Standard entire life plans are based upon long-lasting price quotes of cost, interest and death.

If these estimates alter in later years, the business will certainly adjust the costs accordingly however never ever above the optimum guaranteed premium mentioned in the policy (St Petersburg, FL Life Insurance). An economatic whole visite site life policy attends to a basic amount of getting involved entire life insurance policy with an extra supplementary coverage supplied via making use of returns

Due to the fact that the costs are paid over a shorter span of time, the costs settlements will certainly be greater than under the entire life plan. Solitary costs entire life is minimal payment life where one large superior repayment is made. The plan is totally compensated and no more premiums are required.

Some Known Facts About Hsmb Advisory Llc.

Passion in solitary premium life insurance coverage is largely due to the tax-deferred therapy of the build-up of its cash money values. Taxes will certainly be incurred on the gain, nonetheless, when you surrender the plan.

The advantage is that improvements in rates of interest will be shown faster in passion sensitive insurance policy than in typical; the negative aspect, of program, is that lowers in rates of interest will certainly also be really felt much more quickly in rate of interest delicate whole life. https://pagespeed.web.dev/analysis/https-www-hsmbadvisory-com/gkfdu4b91b?form_factor=mobile. Health Insurance. There are four fundamental passion delicate entire life policies: The universal life policy is really greater than passion delicate as it is designed to reflect the insurance company's existing death and expenditure as well as interest profits rather than historical prices

How Hsmb Advisory Llc can Save You Time, Stress, and Money.

The company credits your costs to the money worth account. Regularly the firm deducts from the cash money value account its expenditures and the expense of insurance policy security, generally explained as the death deduction cost.

These assurances are usually extremely conservative. Present presumptions are vital to passion sensitive items such as Universal Life. When rate of interest are high, advantage estimates (such as money value) are additionally high. When rate of interest are low, these estimates are not as appealing. Universal life is likewise one of the most flexible of all the different sort of plans.

Not known Factual Statements About Hsmb Advisory Llc

It is important that these assumptions be sensible because if they are not, you may need to pay even more to maintain the policy from reducing or expiring. On the various other hand, if your experience is much better then the assumptions, than you may be able in the future to miss a costs, to pay less, or to have the plan compensated at a very early day.

On the various other hand, if you pay more, and your assumptions are sensible, it is feasible to compensate the policy at an early date. If you surrender an universal life plan you might obtain much less than the cash money worth account as a result of surrender charges which can be of two types.

Not known Details About Hsmb Advisory Llc

Report this page